allgn.online

Learn

Banks To Get A Loan With Bad Credit

Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. Find out more about credit scores. · How to pay off credit card debt. · Know your debt-to-income (DTI) ratio. · Good debt vs. bad debt: what's the difference? If you have a poor credit history or a low credit score, you may find yourself unable to get online loans from traditional lenders such as banks. In order to. To determine what credit score is needed for a bad credit loan near you, let's talk about credit ranges and exactly what "bad credit" is. A poor FICO score is. Make the Most of Your Money. Whatever stage you find yourself in life, we have personal checking, savings, credit card and loan options at competitive rates for. You may have more difficulty obtaining credit and will likely pay higher rates for it. Poor ( - ). You may have difficulty obtaining unsecured credit. No. With no collateral required, our TD Fit Loan can offer you an alternative to credit cards or other forms of secured financing that requires collateral. At GNCU, we offer loans for bad credit to help you rebuild your credit and start fresh. If you can qualify for GNCU membership by living or working in Nevada. How to get a business loan with a bad credit score. Having a poor credit score will make it more difficult to obtain financing, but not impossible. 3-minute. Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. Find out more about credit scores. · How to pay off credit card debt. · Know your debt-to-income (DTI) ratio. · Good debt vs. bad debt: what's the difference? If you have a poor credit history or a low credit score, you may find yourself unable to get online loans from traditional lenders such as banks. In order to. To determine what credit score is needed for a bad credit loan near you, let's talk about credit ranges and exactly what "bad credit" is. A poor FICO score is. Make the Most of Your Money. Whatever stage you find yourself in life, we have personal checking, savings, credit card and loan options at competitive rates for. You may have more difficulty obtaining credit and will likely pay higher rates for it. Poor ( - ). You may have difficulty obtaining unsecured credit. No. With no collateral required, our TD Fit Loan can offer you an alternative to credit cards or other forms of secured financing that requires collateral. At GNCU, we offer loans for bad credit to help you rebuild your credit and start fresh. If you can qualify for GNCU membership by living or working in Nevada. How to get a business loan with a bad credit score. Having a poor credit score will make it more difficult to obtain financing, but not impossible. 3-minute.

Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you. P2P Credit offers personal loan access to borrowers with bad credit. Traditional banks often deny loan applications from borrowers with credit scores less than. Whether you need a small personal loan, or you're working to improve bad credit, PFCU offers low rates and fast approval. You can follow these steps to apply for a personal loan with poor credit: Three Lenders That Offer Bad Credit Loans. Some lenders offer personal loans. Bad credit loans are designed for people with poor credit. Money Mart offers bad credit loans with flexible repayment options. Apply online or in person. Bad credit personal loans are an alternative payment solution that helps people with poor credit and bad credit histories access loans and financing to fit. With low rates and flexible terms, our personal loan options help you manage unplanned expenses or get some extra cash. Get the money you need. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required. Installment loans typically have minimum amounts of $1,, but you can find personal installment loans of up to $35,, even with poor credit, so long as you. How to get a loan with bad credit · Personal loans to pay off credit card debt · Payday loan consolidation · Is a debt consolidation loan right for you? Guaranteed Approval Loans For Poor Credit. If you have a poor credit score, you might think you can get guaranteed loan approval by choosing a lender that. Loans for Bad Credit We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on. Through the personal loan program at Axos Bank, you can borrow money Get prequalified in minutes with no impact to your credit score. Get Prequalified. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for. Low credit score no problem. Unexpected expenses, home project, vacations Auto Loans. The right car, truck, or SUV can make life travels more enjoyable. And. Credit Score? Untouched. Get a fixed-rate loan up to $50, for almost anything this summer—and check your rate without impacting. Credit is not built or rebuilt overnight, and improving a poor credit score can take months or years. But at LoanNow, your on-time payments will be reported to. A poor credit score should not be a barrier for individuals who need financial support, and many lenders agree. Even if you believe you have “bad” credit. Rates as low as % APRFootnote 1. Pay for home improvements, make a major purchase, or consolidate debtFootnote 2. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for.

Start Building Wealth

In this article, we will look at 10 actionable steps that you can start working on today to begin to build wealth from nothing and get on track to living a. A short list of 10 steps you can take to build wealth over your military career and protect your nest egg from scammers. First-generation Americans need to start building wealth — here's how they can do it · 1. Start building an emergency fund · 2. Open up a Roth IRA to start. Wealth building involves taking your sustainable business revenue and turning it into income that you invest (both back into your business and into your. What It Means to Build Wealth · Set Goals: Building wealth requires the individual to set realistic goals. · Earn Money: As obvious as it sounds, earning money is. To build wealth, the natural starting place is your employer's retirement plan. It offers important tax advantages, and often your employer offers a matching. Building wealth is a deliberate, step-by-step process you go through over time to give yourself a confident financial future. Venture into business; Increase your income; Improve your skill set; Create a budget; Start an emergency fund; Pay off debt. How do I start building my wealth? You can create personal wealth and meet your goals. By choosing to budget, save and invest, you can pay off debt, send your child to college, buy a comfortable. In this article, we will look at 10 actionable steps that you can start working on today to begin to build wealth from nothing and get on track to living a. A short list of 10 steps you can take to build wealth over your military career and protect your nest egg from scammers. First-generation Americans need to start building wealth — here's how they can do it · 1. Start building an emergency fund · 2. Open up a Roth IRA to start. Wealth building involves taking your sustainable business revenue and turning it into income that you invest (both back into your business and into your. What It Means to Build Wealth · Set Goals: Building wealth requires the individual to set realistic goals. · Earn Money: As obvious as it sounds, earning money is. To build wealth, the natural starting place is your employer's retirement plan. It offers important tax advantages, and often your employer offers a matching. Building wealth is a deliberate, step-by-step process you go through over time to give yourself a confident financial future. Venture into business; Increase your income; Improve your skill set; Create a budget; Start an emergency fund; Pay off debt. How do I start building my wealth? You can create personal wealth and meet your goals. By choosing to budget, save and invest, you can pay off debt, send your child to college, buy a comfortable.

By choosing to budget, save and invest, you can pay off debt, send your child to college, buy a comfortable home, start a business, save for retirement and put. The first step is to create a plan, the second is to monitor your strategy and process, and the third is to evaluate and tweak it if needed. While get-rich-quick schemes sometimes may be enticing, the tried-and-true way to build wealth is through regular saving and investing—and patiently allowing. Knowing how to build wealth requires a relatively simple strategy: earning money, saving money, and investing money. This chart shows you the combo of the monthly saving amount and the rate of return on your wealth that you'll need to achieve that target. 1. Start early. If you want to accumulate wealth, time is the most important factor. The longer you save and invest, the more likely you are to reach your. If you plan to build your net worth based on overly-optimistic expectations of salary or wage increases, or the sustainability of a second job, you may fall. Building wealth is taking disciplined steps over a period of time in order to achieve financial wealth. Here are three steps to take in order to financially. Building generational wealth can provide long-term financial security and opportunities for your children, grandchildren, and beyond. Invest in Financial Markets To build wealth in a meaningful way, the sooner you get started, the better. “Starting early and consistently saving, even in. An excellent place to start is creating a budget for every month, enabling you to see where all your money goes and letting you pre-plan your savings. Also. Set yourself up to earn more · Avoid credit card debt at all costs · Identify your financial goals · Pay your future self · Start investing early and often · Think. You've worked hard to achieve financial success and build your income, but do you know how to build your wealth? Try this exercise: Add up the total. How to Build Wealth · Step 1: Making money · Step 2: Saving money · You may find this useful because you don't ever have the money available to spend in the. Wealth Building Step 1: Spend Less Than You Make & Invest the Difference · Spend less than you make and invest the difference wisely. · Rinse and repeat until. The first step is protecting what you have saved. Then you'll have the freedom to invest and build wealth as you prepare for retirement. Before someone can truly begin building wealth, they must consistently generate enough income to handle month-to-month expenses. It's also a good idea to have. To build wealth, you need to resist consumerism, and adopt a minimalist and frugal lifestyle. You need to be mindful of your spending habits, and only buy. Reframing how to build generational wealth · Begin with a wealth mindset · Secure assets to build wealth · Set your family up for success · Instill financial. 10 Tips For Money Management & Building Personal Wealth · #1 Take Advantage Of Bank Technology · #2 Determine Needs vs. · #3 Shift Your “Want Money” Into Saving/.

Best American First Class Airline

In this article, we'll compare the first-class experiences on three major US airlines: United, American, and Delta. 1. Etihad Airways · Etihad Airways. Photo: · 2. Emirates · Emirates. Photo: · 3. Singapore Airlines · Singapore Airlines. Photo: · 4. Lufthansa. An elevated experience with special amenities for long-distance travel. First Class First The highest level of service on flights across the US. Whether you're flying on the Emirates A or our game‑changing Boeing , you'll experience the World's Best First Class Discover why our customers. Based on the information from various sources, both Delta Airlines and United Airlines offer competitive first-class experiences for domestic. Whether you're flying on the Emirates A or our game‑changing Boeing , you'll experience the World's Best First Class Discover why our customers. Or access our International First Class Lounges and Admirals Club® lounges in other cities. See what you'll earn on American flights. American Airlines. First Class on Alaska means you get the most legroom in any U.S. domestic airline, 2 free checked bags, free drinks, and more. It's First Class done right. Plus, American Airlines is the only airline to still offer true first class on U.S. routes — offering lay-flat seats on select cross-country flights using its “. In this article, we'll compare the first-class experiences on three major US airlines: United, American, and Delta. 1. Etihad Airways · Etihad Airways. Photo: · 2. Emirates · Emirates. Photo: · 3. Singapore Airlines · Singapore Airlines. Photo: · 4. Lufthansa. An elevated experience with special amenities for long-distance travel. First Class First The highest level of service on flights across the US. Whether you're flying on the Emirates A or our game‑changing Boeing , you'll experience the World's Best First Class Discover why our customers. Based on the information from various sources, both Delta Airlines and United Airlines offer competitive first-class experiences for domestic. Whether you're flying on the Emirates A or our game‑changing Boeing , you'll experience the World's Best First Class Discover why our customers. Or access our International First Class Lounges and Admirals Club® lounges in other cities. See what you'll earn on American flights. American Airlines. First Class on Alaska means you get the most legroom in any U.S. domestic airline, 2 free checked bags, free drinks, and more. It's First Class done right. Plus, American Airlines is the only airline to still offer true first class on U.S. routes — offering lay-flat seats on select cross-country flights using its “.

Discounted American Airlines first and business class flights with I Fly First Class. Best prices for luxurious flights. Send request for more information. No one likes to be stuck on a plane for any amount of time, and unless you're flying premium or first-class, it's usually a means to an end. But if you want to. So, which is the best first class airline in the U.S.? The short answer is that, according to our analysis, Delta Air Lines and United Airlines offer the top. For domestic first class, JetBlue is by far the best. As far as I know, Hawaiian and JetBlue are the only airlines in the US to offer lie-flat. A closer look at the 10 best domestic first class products here in the United States ( version) · 1. JetBlue Mint · 2. American Airlines AT Flagship First. An elevated experience with special amenities for long-distance travel. First Class First The highest level of service on flights across the US. United Airlines offers a lounge with the best amenities at San Antonio Airport. There are conference facilities, alcoholic and soft drinks, air conditioning. For amenities and superior service you won't find just anywhere, choose First Class for your next Delta flight. You'll enjoy a wider, more spacious seat. on a U.S. airline, a mirrored vanity, even more storage, and a Rated Best Regional Business Class in North America in by TripAdvisor travelers. Seats: First Class 12 | Main Cabin 52 | Main Cabin Extra Bombardier CRJ the best seats and in-flight amenities. Forum · Mobile · FAQ · Contact Us · Site. In this article, we'll compare the first-class experiences on three major US airlines: United, American, and Delta. The world's 12 best first class airlines · 1. Emirates first class (Boeing ER) · 2. Japan Airlines first class (Airbus A) · 3. Air France first. first class. Quick example: A round trip on American Airlines from New York City to Los Angeles in May (Thursday to Thursday) costs about $ for an. Despite there being first class seats on both domestic and international flights, the experience is very different. In fact, international business class is. In this article, we'll compare the first-class experiences on three major US airlines: United, American, and Delta. Singapore Airlines scoops the top award as the World's Best First Class Airline, also winning the award for the Best First Class Airline Seat. This is whats considered first class on yhe best airline in America called Delta. Pure scam if you ask me. Now I understand why rich people buy jets here. Despite there being first class seats on both domestic and international flights, the experience is very different. In fact, international business class is. REVIEW – American Airlines: First Class – New York to Los Angeles (AT) Undoubtedly the best commercial cabin flying into the Maldives right now 🏝️There's. on a U.S. airline, a mirrored vanity, even more storage, and a Rated Best Regional Business Class in North America in by TripAdvisor travelers.

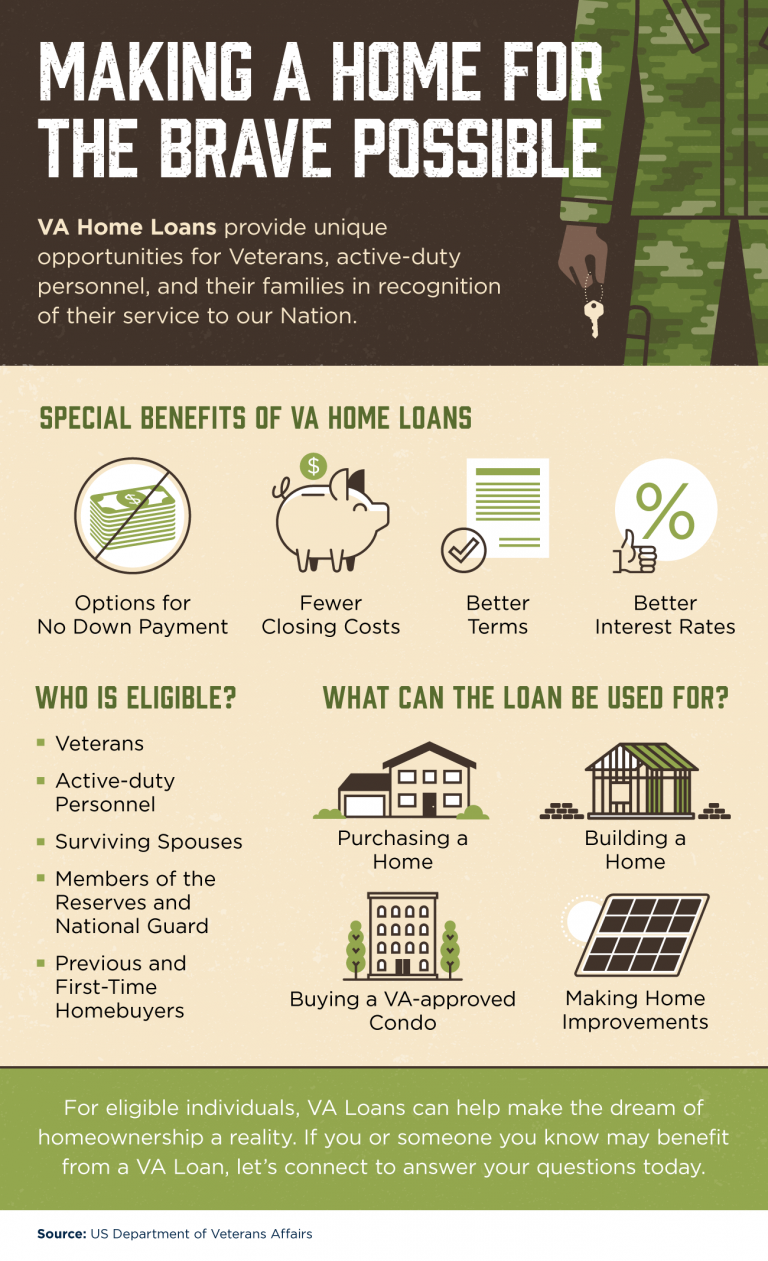

Va Loan Pros And Cons For Buyer

Had a great experience with the most recent VA loan for a single family home on acres in a semi-rural part of New England. I'm % P&T so. For most service members and veterans who qualify, a VA loan is one of their most valuable benefits and a no-brainer over a traditional mortgage. If you qualify. VA loans offer better terms and interest rates than most other home loans. · % financing — typically, there is no down payment required for a VA loan, as long. VA loans have a number of benefits, including no-down-payment options, lower interest rates than conventional mortgages, lower minimum borrower qualifications. VA loan pros include no down payment, no PMI, higher allowable DTI, credit flexibility, better than average interest rates, multiple refinance options, no. Pros of a VA Loan · 1. Easy to qualify · 2. Competitive rates · 3. No PMI or private mortgage insurance fees · 4. No income restrictions · 5. No origination fee. Some home sellers won't accept VA offers because they mistakenly believe they'll have to pay all of the buyer's closing costs. The VA does limit what closing. Another pro of the VA loan is that there is no private mortgage insurance. Private mortgage insurance is usually reserved for those who a conventional buyer. VA loans are a popular choice for Veterans and active military members. There are many advantages to using a VA loan over other government-backed loans or even. Had a great experience with the most recent VA loan for a single family home on acres in a semi-rural part of New England. I'm % P&T so. For most service members and veterans who qualify, a VA loan is one of their most valuable benefits and a no-brainer over a traditional mortgage. If you qualify. VA loans offer better terms and interest rates than most other home loans. · % financing — typically, there is no down payment required for a VA loan, as long. VA loans have a number of benefits, including no-down-payment options, lower interest rates than conventional mortgages, lower minimum borrower qualifications. VA loan pros include no down payment, no PMI, higher allowable DTI, credit flexibility, better than average interest rates, multiple refinance options, no. Pros of a VA Loan · 1. Easy to qualify · 2. Competitive rates · 3. No PMI or private mortgage insurance fees · 4. No income restrictions · 5. No origination fee. Some home sellers won't accept VA offers because they mistakenly believe they'll have to pay all of the buyer's closing costs. The VA does limit what closing. Another pro of the VA loan is that there is no private mortgage insurance. Private mortgage insurance is usually reserved for those who a conventional buyer. VA loans are a popular choice for Veterans and active military members. There are many advantages to using a VA loan over other government-backed loans or even.

Fees range from a little over 2% of the home's purchase price for first-time VA loan recipients to % for repeat home buyers. The good news is you can roll. Assumable Mortgage: What It Is, How It Works, Types, Pros and Cons. By The buyer need not be a military member to assume a VA loan. Buyers must. It also varies if you have used your entitlement to purchase a home before or if the veteran is a first-time home buyer. The funding fee is a one-time charge. The buyer will make a written offer to purchase the home and will then be subject to their lender's approval process. One of the primary differences between VA. Cost Savings: Assuming a VA loan allows the buyer to avoid certain expenses typically associated with new loans, such as closing costs and appraisal fees. VA loans do not require a down payment. · VA loans are multi-purpose. · The VA loan benefit doesn't expire. · You can use a VA loan after bankruptcy or foreclosure. FHA Loan: Pros · Low down payments of as little as % of the home's purchase price · Low closing costs · Buyer minimum credit scores that are lower than required. Since VA home loans are subject to a strict appraisal, this can sometimes make a home seller uneasy, especially if they've never sold to a VA home buyer in the. A buyer who is approved for a VA mortgage is a pretty solid buyer, in most cases,” Gelios said. “VA loans are backed by the government and, therefore, easier to. There are few disadvantages to using your VA loan entitlement. However you should still use it smartly. Having no down payment is both a blessing and a curse. Why choose VA? The VA Home Loan is often the best home loan product for Veterans. Some benefits include: • No down payment as long. It's a win-win for all involved—veterans have an easier time attaining financing, and lenders get peace of mind. The list of VA loan pros and cons has a lot. Unlike conventional loans, where a downpayment of 20% is typically required to avoid private mortgage insurance (PMI), the VA home loan allows eligible. A buyer who is approved for a VA mortgage is a pretty solid buyer, in most cases,” Gelios said. “VA loans are backed by the government and, therefore, easier to. Getting a VA mortgage offers a number of benefits, such as the ability to put a 0% down payment, and often a lower-than-market interest rate. But VA home loans. If youre buying for the first time with a VA home loan your funding fee will be % of the home price. Meaning that if you buy a $k home you. Assumable Mortgage: What It Is, How It Works, Types, Pros and Cons. By The buyer need not be a military member to assume a VA loan. Buyers must. I am currently looking into buying my next property with my VA loan. I plan on house hacking a multi with that loan? Then moving out and renting it a. The VA caps the amount lenders can charge for closing costs. Although the mandatory funding fee is included in this equation, it can be rolled into the loan. In addition to no down payment and no PMI, VA loans offer additional benefits. These include competitive interest rates, lenient credit score requirements, and.

Start Own Cryptocurrency

What some people ignore is that you need money to make it. The coin needs a starting amount, as well as a starting liquidity. Depending on the. In this article, we're looking into how to start a cryptocurrency exchange, why to start it, and how to turn it into a successful business. Creating a cryptocurrency typically requires knowledge in blockchain technology, cryptography, smart contracts, and programming languages. The average cost of developing a cryptocurrency may range between $38k and $91k. The cost of building a cryptocurrency with medium complexity features may range. This article serves as a comprehensive guide, providing step-by-step insights to create a cryptocurrency exchange. This course will guide you through the complete process of how to create a cryptocurrency, Just like Bitcoin and Litecoin, with your own blockchain network. How Can You Start Your Own Cryptocurrency? · 1. Create your own blockchain and native coin · 2. Modify an existing blockchain · 3. Build a new cryptocurrency on. Click “Start”: This will begin your registration. 3. Accept the Terms and Conditions: Make sure to read and agree. ⭐Start Earning $BLUM 1. Click on “Start. To create your own cryptocurrency like Bitcoin, you need a smart technology partner that has a good experience working with future technologies like these. What some people ignore is that you need money to make it. The coin needs a starting amount, as well as a starting liquidity. Depending on the. In this article, we're looking into how to start a cryptocurrency exchange, why to start it, and how to turn it into a successful business. Creating a cryptocurrency typically requires knowledge in blockchain technology, cryptography, smart contracts, and programming languages. The average cost of developing a cryptocurrency may range between $38k and $91k. The cost of building a cryptocurrency with medium complexity features may range. This article serves as a comprehensive guide, providing step-by-step insights to create a cryptocurrency exchange. This course will guide you through the complete process of how to create a cryptocurrency, Just like Bitcoin and Litecoin, with your own blockchain network. How Can You Start Your Own Cryptocurrency? · 1. Create your own blockchain and native coin · 2. Modify an existing blockchain · 3. Build a new cryptocurrency on. Click “Start”: This will begin your registration. 3. Accept the Terms and Conditions: Make sure to read and agree. ⭐Start Earning $BLUM 1. Click on “Start. To create your own cryptocurrency like Bitcoin, you need a smart technology partner that has a good experience working with future technologies like these.

Well, creating a cryptocurrency of your own is very much possible, but still many people are unaware of cryptocurrency(Digital Currency). People need to be. There are many existing blockchain platforms that explain how to create your own cryptocurrency, whether to make a community coin, for fun, or for any other. In this article, we're looking into how to start a cryptocurrency exchange, why to start it, and how to turn it into a successful business. This page provides an extensive guide on how to start an ICO, including detailed instructions on how to Create Your Own Cryptocurrency and the ICO process. There are three main ways to create a cryptocurrency yourself: building your own blockchain (coin), modifying an existing blockchain (coin), or building on top. This comprehensive guide will equip you with the knowledge you need to navigate the process of creating your own cryptocurrency from scratch. For example, you can create a crypto mining startup or NFT trading platform, and launch your cryptocurrency or crypto exchange startup. Finding. Create Your Own Cryptocurrency - If you are planning to create your own cryptocurrency or want to know how to create a cryptocurrency then hire dedicated. The easy and convenient way to create your own cryptocurrency without coding. We set essential cookies to help run our websites and services. By. Before creating your own crypto, you'll need to consider its utility, tokenomics, and legal status. After this, your choice of blockchain, consensus mechanism. To create your own cryptocurrency token, you can create a new blockchain by writing your own code. To complete this method, you will need a lot of technical. We've created a step-by-step tutorial on how to build your cryptocurrency and explained potential risks associated with crypto assets. If you've never created a cryptocurrency before, it may seem daunting. Many people still don't know exactly how to buy crypto, let alone launch their own token. Definitely! It's possible to make money by trading cryptocurrencies like Bitcoin daily. It's called day trading. You buy low and sell high to. The cost of crypto coin creation costs around $5k to $70k and it depends upon your business needs. Many factors influence the cost of creating a cryptocurrency. Welcome to the ultimate course on how to create a cryptocurrency! Join the digital gold rush and change your perspective on money. Cost of Creating your own Cryptocurrency · Selecting the base crypto coin or smart contract, while building the characteristics of the cryptocurrency · Creating. We will help you uncover what cryptocurrencies are, how they function, and how they are made. Moreover, we'll talk about the pros and cons of cryptocurrency. The cost of crypto coin creation costs around $5k to $70k and it depends upon your business needs. Many factors influence the cost of creating a cryptocurrency. be tied to the value of a currency like the US dollar · be backed by other crypto assets · use algorithms that trigger purchases and sales to keep their value.

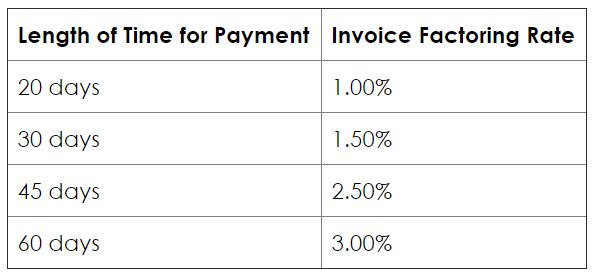

Factoring Company Rates

It is calculated as a percentage of the invoice value and usually ranges from between – 5%. The discount rate only applies to the funds advanced. It is. Fees for factoring services typically compound for the life of the invoice, though flat-fee structures are available for certain industries like trucking. A factoring company may charge 2% for the first 30 days and % for every 10 days that the invoice remains unpaid. Fees are often referred to as invoice. Factoring rates typically range from % to % per 30 days. However, these rates are not fixed and can vary based on several factors. Firstly, volume plays. Factoring rates for average invoices below $5, · "$ set up and contract fees. · "% of receivables up to 30 days." - Manufacturer, New Wilmington. This varies from 1% to 5% of the entire amount (based on the industry and credit profile of the borrowing organization and the factoring firm). Overdue Interest. Average factoring and invoice financing rates vary somewhere between 1 and 6 percent. The main factoring fee is called the transaction fee or discount rate. Factoring Fee (the cost to factor) This fee usually ranges between % - % for the first 30 days and traditionally increases an additional 1% for every. Average 30 Day Factoring Rates ; B2B Business, 70% to 85%, 1% to % ; Construction, 70% to 80%, % to 4% ; Medical Billing, 60% to 80%, % to % ; Staffing. It is calculated as a percentage of the invoice value and usually ranges from between – 5%. The discount rate only applies to the funds advanced. It is. Fees for factoring services typically compound for the life of the invoice, though flat-fee structures are available for certain industries like trucking. A factoring company may charge 2% for the first 30 days and % for every 10 days that the invoice remains unpaid. Fees are often referred to as invoice. Factoring rates typically range from % to % per 30 days. However, these rates are not fixed and can vary based on several factors. Firstly, volume plays. Factoring rates for average invoices below $5, · "$ set up and contract fees. · "% of receivables up to 30 days." - Manufacturer, New Wilmington. This varies from 1% to 5% of the entire amount (based on the industry and credit profile of the borrowing organization and the factoring firm). Overdue Interest. Average factoring and invoice financing rates vary somewhere between 1 and 6 percent. The main factoring fee is called the transaction fee or discount rate. Factoring Fee (the cost to factor) This fee usually ranges between % - % for the first 30 days and traditionally increases an additional 1% for every. Average 30 Day Factoring Rates ; B2B Business, 70% to 85%, 1% to % ; Construction, 70% to 80%, % to 4% ; Medical Billing, 60% to 80%, % to % ; Staffing.

The most obvious part of the cost is the factoring rate. This is the percentage of your invoices the factoring company charges to send your funds. For example. Fourth, the fee structure varies between factoring companies, so it's crucial to assess their rates and ensure they align with your business needs and financial. Factoring companies usually calculate their fees based on a variable fee structure. With a variable fee, a small percentage (up to 3 per cent) is deducted from. The average invoice factoring rates tend to be around % of the value of the invoice with all fees considered, but the way lenders arrive at the cost can. What Factoring Rate Can Your Company Get? Generally, you can expect to pay from 1 to 4% of the invoice amount factored as invoice factoring fees. Factoring Fee: % – % + Potential penalties for late payments and a $6 non-sufficient funds fee ; Advance Rates: Up to % of the invoice amount or up to. The factoring rate is the fee a business pays for the factoring service – and how the factoring company makes money. You'll sometimes see the factoring rate. The typical factoring cost is a few percent of the invoice amount, depending on several components such as: Some of our factoring fees are as low as 1%. For a reputable company with consistent, recurring revenue from a reputable customer base, a good invoice factoring rate may be somewhere in the ballpark of ACH Fee: This is a transaction fee that factoring companies may choose to assess anytime funds are transferred via ACH. It typically ranges between $5 and $ Our choice for best overall, altLINE, has factoring rates starting as low as %, but rates less than 1% are most likely only on invoices that customers will. Factoring Rate / Factoring Fee: this is the most obvious. It's a percentage of the invoice that the factoring company will keep for themselves. Typically 2% – 5. As an example, say you have a $10, invoice. The factoring company will agree to buy it for $9, ($10, minus a 4% factoring fee). They give you a cash. Freight factoring costs are usually calculated as a percentage of the invoice that is charged by the company in return for their services (generally 2% or more). Freight factoring rates typically fall in the range of 1% to 3% of the invoice amount. This fee is often paid upfront when you apply for financing, allowing you. Generally, factoring rates depend on the total amount of invoicing you are able to sell. The more monthly volume you factor, the lower the rate you'll be. The invoice factoring rate is the discount rate used to calculate factoring fees. The advance rate is usually between % to 5%. You can expect typical factoring fees for a funding company to be somewhere along the lines of 2%–% for the first month and then about % for every. Factoring company rates. Over 40 proven years providing the best factoring rates for companies nationwide. Only a handful of factoring companies can say.

Mortgage Interest Rates Bay Area

Average rate on a year mortgage falls to %, lowest level in more than a year · The average rate on a year mortgage fell this week to its lowest level. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. The current average year fixed mortgage rate in California decreased 1 basis point from % to %. California mortgage rates today are 2 basis points. We're a Top SBA Lender in the Bay Area. Get the funds you need to move the Loan interest rates are based on current market rates, are subject to. The interest rate for loans approved during the period August 1, through October 31, will be %. The Mortgage Origination Program is a pre-approval. View all rates. Interest Rate. as low as %. APR. as low as %. Highlights. Competitive interest rates. Receive competitive rates on fixed and. Current rates in San Francisco, California are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd. Home Loan Rates ; Super-Conforming / Jumbo 30 Year Fixed Rate, %, % ; Conforming 15 Year Fixed Rate, %, % ; Conforming 5/1 Adjustable Rate. Compare California mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Average rate on a year mortgage falls to %, lowest level in more than a year · The average rate on a year mortgage fell this week to its lowest level. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. The current average year fixed mortgage rate in California decreased 1 basis point from % to %. California mortgage rates today are 2 basis points. We're a Top SBA Lender in the Bay Area. Get the funds you need to move the Loan interest rates are based on current market rates, are subject to. The interest rate for loans approved during the period August 1, through October 31, will be %. The Mortgage Origination Program is a pre-approval. View all rates. Interest Rate. as low as %. APR. as low as %. Highlights. Competitive interest rates. Receive competitive rates on fixed and. Current rates in San Francisco, California are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd. Home Loan Rates ; Super-Conforming / Jumbo 30 Year Fixed Rate, %, % ; Conforming 15 Year Fixed Rate, %, % ; Conforming 5/1 Adjustable Rate. Compare California mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans.

Bay Area · California Wildfires · Education · Weather · Health · Politics · Local · SF (The Fed doesn't set mortgage rates, but interest on all types of. On Sunday, August 25, , the average APR in California for a year fixed-rate mortgage is %, an increase of 9 basis points from a week ago. Meanwhile. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: payments of $2, at an interest rate of %. Mortgage Rates ; 15 Year Conforming, %, % ; 15 Year Jumbo, %, % ; 10 Year Conforming, %, % ; 7 Year Conforming, %, %. 09/01/ in san-francisco, california Multifamily/Apartment loan rates start from % for a 10 year fixed with 30 year amortization. All mortgage loans through Monterra Credit Union are for homes in California only. Francisco Bay Area. Explore our personal, business and wealth management. The average California mortgage rate for a fixed-rate year mortgage is % (Zillow, Jan. ). California Jumbo Loan Rates. Homes in California tend to be. The annual percentage rate (APR) is the cost of credit over the term of the loan expressed as an annual rate. The APR shown here is based on the interest rate. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Today's Mortgage Rates ; Year Mortgage · % ·: %**** Jumbo: %***** ; Year Mortgage · ·: %**** Jumbo: %*****. The average year fixed-rate mortgage loan in California currently has an interest rate of about %. The interest rates for year loans are slightly. Fixed Rate Conforming Mortgages ; 15 · %, %, %, $ ; 10, %, %, %, $ On Sunday, August 25, , the average APR in California for a year fixed-rate mortgage is %, an increase of 9 basis points from a week ago. Meanwhile. View all rates. Interest Rate. as low as %. APR. as low as %. Highlights. Competitive interest rates. Receive competitive rates on fixed and. Buying our forever home in the Bay Area and it hurts, the amount we will have to pay every month. Definitely trying to find the lowest rate but. Bay Area can cost $7, a year in property taxes. While campaigning Joe Biden stated he wanted to set the top marginal tax rate at % and re-impose FICA. Why an SF Fire Fixed-Rate Mortgage? ; Competitive. $ Flat Fee ; Rates as low as. %. 15 Year Fixed* ; Close. Quickly. On Your Dream Home. mortgage rates · Average rate on a year mortgage falls to % · Nearly half of US needs $k+ income to afford median-priced home · New home sales ticked up. Today's mortgage rates in California are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check.

Vnd Dong

The Vietnamese Dong refers to Vietnam's official currency and is represented by ISO code VND. The word “dong” implies money in Vietnamese. Prices for USDVND US Dollar Vietnamese Dong including live quotes, historical charts and news. USDVND US Dollar Vietnamese Dong was last updated by Trading. The Vietnamese Dong is the currency of Viet Nam. Our currency rankings show that the most popular Vietnamese Dong exchange rate is the VND to USD rate. The. This guide walks through the best available options to buy Vietnamese Dong in the United States, whether you want cash in your wallet before you leave, or. Check the latest currency exchange rates for the US Dollar, Vietnamese Dong and all major world currencies. Our currency converter is simple to use and also. Get US Dollar/Vietnam Dong FX Spot Rate (VND=:Exchange) real-time stock quotes, news, price and financial information from CNBC. The State Bank of Vietnam (SBV) is the sole issuer of the currency of the Socialist Republic of Vietnam. Its monetary unit is the Dong. Check out our live CAD to VND exchange rates, then easily send Canadian Dollars to Vietnamese Dong or spend with your card in Vietnam. The dong is the official currency in Vietnam, although it arrived in different times to North Vietnam and South Vietnam, before the unification of the. The Vietnamese Dong refers to Vietnam's official currency and is represented by ISO code VND. The word “dong” implies money in Vietnamese. Prices for USDVND US Dollar Vietnamese Dong including live quotes, historical charts and news. USDVND US Dollar Vietnamese Dong was last updated by Trading. The Vietnamese Dong is the currency of Viet Nam. Our currency rankings show that the most popular Vietnamese Dong exchange rate is the VND to USD rate. The. This guide walks through the best available options to buy Vietnamese Dong in the United States, whether you want cash in your wallet before you leave, or. Check the latest currency exchange rates for the US Dollar, Vietnamese Dong and all major world currencies. Our currency converter is simple to use and also. Get US Dollar/Vietnam Dong FX Spot Rate (VND=:Exchange) real-time stock quotes, news, price and financial information from CNBC. The State Bank of Vietnam (SBV) is the sole issuer of the currency of the Socialist Republic of Vietnam. Its monetary unit is the Dong. Check out our live CAD to VND exchange rates, then easily send Canadian Dollars to Vietnamese Dong or spend with your card in Vietnam. The dong is the official currency in Vietnam, although it arrived in different times to North Vietnam and South Vietnam, before the unification of the.

Convert Vietnamese dong VND to Canadian dollars CAD. Use Alpari's converter to quickly and conveniently make currency conversions online. A great tool to understanding money in Vietnam and the value of Vietnamese Dong in relation to the 10 most common foreign currencies in Vietnam. Currency converter to convert from Vietnamese Dong (VND) to United States Dollar (USD) including the latest exchange rates, a chart showing the exchange. VND (Vietnamese Dong): Get info about ✓VND Symbol ✓Vietnamese Dong exchange rate ✓Vietnamese Dong Profile ✓Popular Currency Conversion from VND to other. Our currency converter will show you the current VND to USD rate and how it's changed over the past day, week or month. Currency converter to convert from United States Dollar (USD) to Vietnamese Dong (VND) including the latest exchange rates, a chart showing the exchange. VNDUSD | A complete Vietnamese Dong/U.S. Dollar currency overview by MarketWatch. View the currency market news and exchange rates to see currency strength. The Vietnamese dong is the currency of Vietnam. The banknotes have both a paper banknote and polymer (plastic) banknote series in circulation. VND/USD - Vietnamese Dong US Dollar · Prev. Close: · Bid/Ask: / · Day's Range: - United States Dollar - Vietnamese Dong (USD - VND)Currency · Currency Snapshot · News · Historical Prices for Vietnamese Dong · Currencies Pairs. The Vietnamese Dong is expected to trade at by the end of this quarter, according to Trading Economics global macro models and analysts expectations. The đồng is the currency of Vietnam. The most popular Vietnamese đồng conversion is into US dollars. The currency code for the đồng is VND, and it's also. Check today's Canadian Dollar to Vietnamese Dong exchange rate with Western Union's currency converter. Send CAD and your receiver will get VND in minutes. Currently, Vietnam uses the Vietnamese dông (VND). At one time, the dông subdivided into hao, but since they are no longer legal tender, the dông no longer. View the latest VND to USD exchange rate, news, historical charts, analyst ratings and financial information from WSJ. OnlineFX lets you order Vietnamese Dong online for home delivery or in branch pick up at one of Currency Exchange International's many branch locations. Buy Vietnamese Dong - VND online. Home delivery anywhere in Canada. All backed by our best price guarantee. Use the VND to USD currency converter at allgn.online for accurate and up-to-date exchange rates. Easily convert Vietnamese Dong to US Dollars with. The dồng is the national currency for Vietnam, which replaced the use of separate North and South Vietnamese money in VND to USD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Vietnamese Dong/U.S. Dollar.

Which Investment Would Be Worth The Most After 20 Years

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Index funds: This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively. 20 years, according to estimates by the consulting firm Cerulli Associates. investments in their portfolios had more than doubled since , to 26%. 1. Stocks Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a bit). Stocks. While this is a small difference initially, it can add up significantly when compounded over time. After 20 years, the investment will have grown to $ invested for five, 10, 15, 20 or more years. Here are some options for In nine years, your $5, investment will be worth about $10,, in If you got twice as much as you invested and you haven't spend more than 1 hour a year to check it out and if this return is after tax and. Stocks are considered the best investment in terms of historical rate of return, outperforming other instruments, including bonds. Diversification is a way to avoid overexposure to any one stock. Having a portfolio made up of multiple stock protects you if one of them loses. You will need to invest years to reach the target of $1,, End investment will result in a more accrued return and a higher end value. Index funds: This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively. 20 years, according to estimates by the consulting firm Cerulli Associates. investments in their portfolios had more than doubled since , to 26%. 1. Stocks Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a bit). Stocks. While this is a small difference initially, it can add up significantly when compounded over time. After 20 years, the investment will have grown to $ invested for five, 10, 15, 20 or more years. Here are some options for In nine years, your $5, investment will be worth about $10,, in If you got twice as much as you invested and you haven't spend more than 1 hour a year to check it out and if this return is after tax and. Stocks are considered the best investment in terms of historical rate of return, outperforming other instruments, including bonds. Diversification is a way to avoid overexposure to any one stock. Having a portfolio made up of multiple stock protects you if one of them loses. You will need to invest years to reach the target of $1,, End investment will result in a more accrued return and a higher end value.

Total stock market and/or S&P low cost index funds. Max out a Roth IRA every year. investment will be worth in real terms a number of years down the road. This Investment totals $, after 25 years. *indicates required. If you'd rather take the time to set which cookies we can use, click “Customize.” Your choices can always be changed at a later date. More information here. That number gives you the approximate number of years it will take for your investment to double. investments which will fluctuate in value. It does. Some of the most potentially rewarding investments are also the riskiest. Here's a look at eight of them that, when paired with research and smart planning. Approximately how much of the initial investment's value would be lost after 15 years at 3% inflation? Which investment advice would Gale most likely give to. After 20 years, it doubled in value ($1,) and continued to earn interest ($) until reaching maturity after 30 years. If you redeem your bond today, you. You might be willing to take more risks if you have a longer time to save Since , the highest month return was 61% (June through June. “Traditionally high risk-high reward investments, like cryptocurrency or growth-focused stocks, offer more volatility for investors. For those looking to take. you have lent money to the company. 3. Over the past 70 years, the type of investment that has earned the most money, or the highest rate of. can increase this to see how much you can earn over more years.) If you got a 6% return compounded annually for two years, your investment would be worth. Investment goal: Your goal for the total value of your investment or investments. · Years to accumulate: The number of years you have to save. · Amount of initial. While this is a small difference initially, it can add up significantly when compounded over time. After 20 years, the investment will have grown to $ Length of time, in years, that you plan to save. Step 3: Interest Rate Learn more about an investment professional's background registration status, and more. Keep in mind that when investing in stocks, you shouldn't just be throwing your money at random individual stocks. A tried-and-true strategy is to invest in. Estimated Retirement Savings. In 0 years, your investment could be worth: $0 And since we like to say, “Never invest in something you don't. It is more fun to look at nominal returns. Nominal returns show the gross profit. Buy something for $1, and sell it three years later for $1,, the nominal. EE Bonds. Guaranteed to double in value in 20 years. Earn a fixed rate of Can cash in after 1 year. (But if you cash before 5 years, you lose 3. Investment totals $, after 25 years. *indicates required If you check the box to adjust this amount for inflation, your annual investment will. What will $10, be worth in 20 years? The value of $10, in 20 years depends on factors like inflation and investment returns. Assuming an average annual.

How To Use Robinhood App

Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood is a free app that you can use to buy and sell stocks and other investments and build your portfolio. It's simple to use even if you know nothing. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? Robinhood offers commission-free stock, ETF and options trades, a streamlined trading platform and free cryptocurrency trading. But customer. Young man using a trading app stock photo. Credit: iStock/JGalione And companies like Robinhood and its competitors should encourage learning. Explore the Robinhood App to place trades on Nasqad & NYSE. Invest in stocks Robinhood uses industry-standard encryption, and the company is an SEC. The building blocks of your financial journey. What you need to know about investing from the get-go. Robinhood Learn. Stocks & Retirement: Robinhood Financial Crypto trading: Robinhood Crypto Spending/Debit: Robinhood Money Credit Card: Robinhood Credit Support: They will use. You can sign up for a Robinhood spending account in the app by going to Spending (money icon) → Sign up. If you're not a Robinhood customer yet, you'll need. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood is a free app that you can use to buy and sell stocks and other investments and build your portfolio. It's simple to use even if you know nothing. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? Robinhood offers commission-free stock, ETF and options trades, a streamlined trading platform and free cryptocurrency trading. But customer. Young man using a trading app stock photo. Credit: iStock/JGalione And companies like Robinhood and its competitors should encourage learning. Explore the Robinhood App to place trades on Nasqad & NYSE. Invest in stocks Robinhood uses industry-standard encryption, and the company is an SEC. The building blocks of your financial journey. What you need to know about investing from the get-go. Robinhood Learn. Stocks & Retirement: Robinhood Financial Crypto trading: Robinhood Crypto Spending/Debit: Robinhood Money Credit Card: Robinhood Credit Support: They will use. You can sign up for a Robinhood spending account in the app by going to Spending (money icon) → Sign up. If you're not a Robinhood customer yet, you'll need.

Open an account. Put in money. Select stocks. Wait. What kind of stocks are you thinking about?

When you open an account with Robinhood, you get a debit card in the mail with a $1 pre-loaded on it. To buy or sell stocks, you log onto the app and select the. But rather than just 'looking,' Robin Hood has a team of whitehat hackers constantly trying to break through its defenses. That way, Robinhood can stay one step. I am such an introductory investor, not working with high assets. But, I use the Robinhood app, and let me say, it is better than other. Robinhood investing accounts To suit your investing goals and needs, you can trade in a margin account or a cash account. There are some key differences. How to buy a stock. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. In April , Robinhood launched Robinhood Connect, allowing users to trade cryptocurrency using "Free stock trade app Robinhood monetizes with $10/month to. Over 10 million people use Robinhood as their primary trading platform. Activity has dropped on the platform since Robinhood annual users to (mm). Robinhood App Review: Mobile Experience. Robinhood was designed as a mobile trading app for on-the-go investing. So users can access all platform features on. Robinhood is known primarily as an online discount brokerage that offers a commission-free investing and trading platform. · In , the company generated the. To apply for a Robinhood account, you'll need to have a device that meets Robinhood is available for iPhone and Apple Watch on the App Store. We. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Other fees may apply*. To get started trading options on Robinhood, you need to open and fund an account. You can download the app to your smartphone or access the sign-up page on a. Not all brokers offer a bonus to new investors, but Robinhood will add one share of free stock to your brokerage account when you link your bank account and. «Previous Post How to use the robinhood app to trade and invest tutorial | Jason Brown | The Brown Report | Power Trades University Next Post» How to use. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. the basic mobile site. Use Facebook app. tap to use a supported browser. Chrome · Firefox · Edge · Samsung · Facebook wordmark. Log in. Cover photo of Robinhood. You can use Robinhood to buy ETFs. They have a very simple objective Robinhood App · Stocks. What You Get for Free With Robinhood · How does the Free Stock Promotion Work? · Once You Open Your Robinhood Account and Add Cash, Then What? · How do you. Unlike other online brokerages that offer apps, the Robinhood app is the only way you can make stock trades with Robinhood. Robinhood uses a card-based.

1 2 3 4 5 6